Germany and the EU in 2026: How Regulation Is Redefining Fintech Competitiveness

A New Phase for European Fintech - And a Tougher Rulebook

By early 2026, the European fintech sector has matured into one of the most sophisticated innovation ecosystems globally, yet it is also one of the most tightly supervised. Nowhere is this duality more visible than in Germany, where a powerful combination of regulatory rigor, institutional conservatism, and European-level rulemaking is reshaping how digital finance companies build, scale, and internationalize their business models. For readers of FinanceTechX, this evolution is not an abstract policy debate but a daily operational reality, influencing everything from product design and fundraising to hiring, partnerships, and long-term strategy.

The regulatory environment in the European Union (EU) has shifted decisively from experimentation to consolidation. The Markets in Crypto-Assets Regulation (MiCA) is now fully in force, the Digital Operational Resilience Act (DORA) has entered its implementation phase, and the new Anti-Money Laundering Authority (AMLA) in Frankfurt is preparing to assume direct supervisory powers over high-risk institutions. At the same time, the European Central Bank (ECB) is advancing the design of the digital euro, while national regulators such as BaFin in Germany continue to enforce some of the strictest interpretations of European law anywhere in the Single Market.

This confluence of national and EU-level rules has created a demanding, sometimes unforgiving environment, but it has also produced a powerful testbed for resilient business models, robust governance, and high-trust digital finance infrastructure. In this context, Germany and the wider EU are becoming a reference point for global debates on how to reconcile innovation with stability, competition with consumer protection, and data-driven business models with fundamental rights and security.

Germany's Fintech Ecosystem in 2026: Scale, Scrutiny, and Strategic Choices

Germany remains one of Europe's most important fintech markets, with Berlin, Frankfurt, Munich, and increasingly Hamburg anchoring a dense network of startups, scale-ups, and financial incumbents. Digital banks such as N26, trading platforms like Trade Republic, and banking-as-a-service pioneers including Solaris (formerly Solarisbank) have demonstrated that German-born fintechs can achieve significant scale across the EU and beyond. According to updated data from sources such as Statista, the number of fintech companies active in Germany has continued to grow since 2025, even as funding conditions tightened and regulatory requirements intensified.

Yet founders and investors operating in this environment frequently describe regulation as both a moat and a barrier. The supervisory stance of BaFin is widely regarded as among the strictest in Europe, with demanding expectations around capitalization, governance, and risk management even for relatively young firms. Licensing under the German Banking Act (KWG) or Payment Services Act (ZAG) often entails multi-year preparation, detailed dialogue with supervisors, and significant upfront investment in compliance infrastructure that would be more typical of established banks in other jurisdictions. While this reduces the risk of lightly regulated entrants destabilizing the market, it also slows experimentation and can make Germany less attractive as a first licensing jurisdiction compared with countries such as Lithuania, Ireland, or Luxembourg.

For founders and executives profiled on FinanceTechX's dedicated founders hub, this trade-off has become a central strategic question: should they accept Germany's higher regulatory bar in exchange for long-term credibility and access to Europe's largest economy, or should they pursue a more agile licensing path elsewhere in the EU and treat Germany as a secondary market?

Licensing and Passporting: Fragmentation Behind the Single Market

The EU's promise of a Single Market for financial services, based on passporting rights and mutual recognition, remains only partially fulfilled in practice. In theory, a fintech authorized as an electronic money institution or payment institution in one member state should be able to provide services across the bloc without duplicative licensing. In reality, divergent interpretations of key directives and regulations create a patchwork of expectations that can undermine scalability.

The implementation of the Second Payment Services Directive (PSD2), the Electronic Money Directive (EMD), and now MiCA has exposed these differences. A firm licensed in Germany under KWG or ZAG may find that customer due diligence standards, outsourcing rules, or reporting templates in France, Spain, or the Netherlands differ enough to require additional legal work, product adjustments, or local compliance staff. The resulting friction is particularly visible for companies operating in high-growth verticals such as instant payments, open banking aggregation, and embedded finance.

Many European fintechs have responded by adopting a "multi-home" regulatory strategy, securing licenses in more than one jurisdiction to optimize speed, cost, and access. While this can reduce time to market, it also increases complexity and can attract closer scrutiny from authorities wary of regulatory arbitrage. Readers exploring cross-border strategies and business model design on FinanceTechX Business will recognize that regulatory architecture is now as central to competitive positioning as user experience or pricing.

BaFin After Wirecard: From Crisis to Digital Supervision

The collapse of Wirecard in 2020 continues to shape regulatory culture in Germany. In the years since, BaFin has undergone institutional reforms, strengthened its enforcement tools, and significantly expanded its oversight of digital financial services. For fintechs, this has translated into more frequent on-site inspections, deeper scrutiny of outsourcing arrangements, and a stronger emphasis on fit-and-proper assessments for management and key function holders.

At the same time, BaFin has been under pressure to modernize its own capabilities to keep pace with AI-driven business models, cloud-native infrastructures, and complex API ecosystems. The authority has invested in supervisory technology, data analytics, and specialized digital finance teams, while experimenting with innovation hubs and dialogue formats intended to improve communication with startups and scale-ups. However, industry feedback collected by think tanks such as the Centre for European Policy Studies (CEPS) and organizations like the European Banking Federation suggests that many firms still perceive guidance as slow, sometimes inconsistent, and not always aligned with the rapid iteration cycles typical of fintech.

For companies featured in FinanceTechX's AI coverage, this "digital transformation dilemma" within supervision has direct consequences. The more fintechs rely on machine learning, alternative data, and complex decisioning engines, the more they need supervisors who can understand, challenge, and appropriately calibrate the associated risks without stifling innovation.

The Digital Finance Package, MiCA, and DORA: A New European Baseline

The European Commission's Digital Finance Package has moved from legislative drafting to implementation, fundamentally reshaping the regulatory baseline for fintechs across the continent. MiCA, which now governs crypto-asset issuance and service provision, establishes licensing, governance, and disclosure requirements for a wide range of actors, from centralized exchanges to stablecoin issuers. The European Securities and Markets Authority (ESMA) and the European Banking Authority (EBA) have issued extensive technical standards and guidelines, making the framework increasingly granular.

Germany has incorporated MiCA into its national system but has layered it with additional requirements, particularly in the field of anti-money laundering and prudential oversight. Crypto-asset service providers must still obtain authorization from BaFin, meet enhanced due diligence expectations, and demonstrate robust segregation of client assets. This dual regime is more demanding than in some other member states but reinforces Germany's positioning as a jurisdiction focused on investor protection and systemic stability. Readers interested in the evolving crypto landscape can explore deeper analysis on FinanceTechX Crypto.

In parallel, DORA has introduced a horizontal framework for digital operational resilience across all financial entities, including banks, payment institutions, investment firms, and fintechs. By imposing harmonized requirements for ICT risk management, incident reporting, testing, and oversight of critical third-party providers, DORA pushes even smaller fintechs to professionalize their technology governance to a level previously expected mainly of large incumbents. Institutions and observers can follow developments through resources such as the European Commission's digital finance pages and the European Central Bank.

Data Protection and GDPR: Innovation Within Tight Boundaries

For data-driven companies, the General Data Protection Regulation (GDPR) remains both a constraint and a differentiator. Fintechs in Germany, the United Kingdom, France, Italy, and across Europe increasingly compete on their ability to deliver personalized, real-time services without compromising privacy or data security. In Germany, oversight by the Federal Commissioner for Data Protection and Freedom of Information (BfDI) and state-level authorities is particularly robust, with high expectations around lawful basis, transparency, data minimization, and security measures.

This environment forces fintechs to design products with privacy by design and by default, from biometric authentication to behavioral analytics and open banking aggregation. It also complicates the adoption of some AI techniques, especially when models rely on sensitive or inferred data. The tension between frictionless user journeys and explicit, informed consent remains a core challenge, especially in mobile-first onboarding flows and embedded financial services integrated into e-commerce or social platforms.

Global companies benchmark Germany's approach against other major jurisdictions, including the United States, Canada, and Singapore, where privacy frameworks differ significantly. For readers tracking regulatory and market news on FinanceTechX News, understanding these differences has become essential to assessing where and how to deploy new data-intensive products.

AML and the Rise of AMLA: Centralized Supervision with German Characteristics

Anti-money laundering remains one of the most resource-intensive compliance domains for fintechs. In Germany, the Money Laundering Act (GwG), enforced by BaFin and the Financial Intelligence Unit (FIU), requires rigorous Know Your Customer (KYC) processes, transaction monitoring, sanctions screening, and suspicious activity reporting. After a series of high-profile enforcement actions against both traditional institutions and digital-only players, supervisory expectations have tightened further, emphasizing risk-based approaches, effective governance, and demonstrable outcomes rather than mere formal compliance.

The establishment of the Anti-Money Laundering Authority (AMLA) in Frankfurt, expected to become fully operational in 2026, marks a turning point. AMLA will directly supervise selected high-risk entities and coordinate national authorities, aiming to reduce fragmentation and close loopholes exploited by cross-border financial crime. For fintechs operating across Europe, this centralization offers the prospect of more consistent standards but will likely also bring more intensive scrutiny and higher expectations for data quality and analytics capabilities. Institutions such as the Financial Action Task Force and professional bodies like ACAMS provide additional guidance on best practices that many German fintechs now integrate into their internal policies.

AMLA's presence in Germany underscores the country's role as a regulatory hub and sends a clear signal that EU policymakers expect sophisticated compliance capabilities from digital finance firms, regardless of their size or origin.

Crypto, DeFi, and Tokenization: Between Opportunity and Overlapping Rules

By 2026, the crypto market has moved beyond its speculative peaks and troughs into a more institutionalized phase, with tokenization of securities, real-world assets, and fund shares gaining traction across Switzerland, Luxembourg, France, and Germany. MiCA provides a baseline for many activities, but national rules still matter greatly, especially in areas where EU law remains incomplete, such as decentralized finance (DeFi), non-fungible tokens (NFTs), and certain forms of algorithmic stablecoins.

In Germany, BaFin's long-standing classification of certain crypto-assets as financial instruments and its requirement for a crypto custody license have created one of the most demanding regulatory regimes in Europe. Firms must demonstrate robust governance, IT security, segregation of assets, and clear risk disclosures. While some entrepreneurs have chosen more permissive jurisdictions for their core operations, many institutional players and more mature crypto companies now regard a German license as a mark of reliability when serving corporate, banking, or wealth management clients. Market intelligence from providers such as Chainalysis and CoinShares shows that institutional adoption and compliance-oriented products have become key growth areas.

For a global audience following digital asset regulation and market structure, FinanceTechX Crypto offers a lens on how German and EU rules are influencing innovation patterns from North America to Asia and Africa.

Embedded Finance, Insurtech, and AI: Blurred Boundaries, Sharper Rules

The rapid expansion of embedded finance and Insurtech has raised new regulatory questions in Germany and across the EU. When retailers, mobility platforms, or software providers embed lending, payments, or insurance into their customer journeys, the lines between licensed and unlicensed entities, and between financial and non-financial activities, become less clear. German regulators have responded by tightening their interpretation of consumer credit and insurance distribution rules, ensuring that ultimate responsibility for compliance cannot be outsourced or obscured by contractual structures.

The growth of "buy now, pay later" (BNPL) offerings, for example, has triggered closer scrutiny of affordability checks, marketing practices, and complaint handling. Similarly, Insurtech firms using AI-driven underwriting and pricing must comply with non-discrimination obligations under the General Act on Equal Treatment (AGG) and EU insurance law, while preparing for the impact of the EU Artificial Intelligence Act, which classifies many financial AI systems as high-risk and subjects them to strict governance and transparency requirements. Organizations such as the European Insurance and Occupational Pensions Authority and the OECD have highlighted both the benefits and risks of algorithmic decision-making in financial services.

For readers exploring the intersection of AI, risk, and regulation, FinanceTechX AI and FinanceTechX Security provide in-depth coverage of how firms are redesigning their architectures, model governance, and audit capabilities to align with emerging rules.

Cybersecurity, DORA, and Critical Infrastructure Obligations

Cybersecurity has become a board-level issue across the financial sector, and fintechs are no exception. Under DORA, firms must implement comprehensive ICT risk management frameworks, conduct regular testing, and ensure resilience against a wide range of threats, from ransomware to supply-chain attacks. For many German fintechs, these obligations intersect with national rules such as the IT Security Act 2.0, which can classify certain platforms as critical infrastructure, imposing additional reporting, redundancy, and protection requirements.

This regulatory focus reflects a broader recognition that digital finance is now part of essential economic infrastructure, not a niche or experimental segment. The European Union Agency for Cybersecurity (ENISA) and national authorities publish guidance and threat intelligence that many fintechs now integrate into their security operations centers and incident response playbooks. For companies competing for cybersecurity and risk talent in the United States, United Kingdom, Israel, Singapore, and South Korea, these obligations also shape hiring strategies and partnerships.

Readers tracking the evolving skills landscape and employment opportunities in this field can find further insight on FinanceTechX Jobs, where cybersecurity, compliance, and data protection roles feature prominently across Europe, Asia, and North America.

The Digital Euro: Strategic Uncertainty for Payments and Banking

The ECB's digital euro project has progressed from concept to detailed design and pilot phases, with legislative proposals advancing through the EU's institutional process. For German fintechs, particularly those active in payments, neobanking, and e-wallets, the digital euro represents both a potential platform for new services and a source of deep strategic uncertainty.

If implemented with intermediated models that rely on banks and payment institutions to distribute and manage digital euro wallets, the initiative could create new roles for fintechs as front-end providers, identity managers, or value-added service developers. If, however, the design were to centralize too many functions at the level of the Eurosystem, private solutions could be crowded out, and margins in the already competitive payments space could compress further. The ECB and Deutsche Bundesbank have emphasized that they seek to complement, not replace, private sector offerings, but many startups and scale-ups feel that their perspectives receive less attention than those of large banks or card schemes.

For global observers comparing central bank digital currency (CBDC) strategies in China, Sweden, Brazil, South Africa, and elsewhere, the digital euro debate offers a case study in how advanced economies attempt to modernize monetary infrastructure without destabilizing existing financial intermediation. Policy updates and technical papers are regularly published on the ECB's website and by national central banks such as Deutsche Bundesbank.

Talent, Education, and the Compliance Skills Gap

The tightening regulatory environment has amplified a structural challenge across the European fintech ecosystem: a shortage of professionals who combine legal, regulatory, technological, and business expertise. German fintechs increasingly compete with traditional banks, insurers, and Big Tech firms for compliance officers, AML specialists, data protection experts, and regulatory technologists. Salary inflation and intense competition make it difficult for early-stage companies to attract and retain the necessary talent, especially in high-cost cities such as Frankfurt, Munich, Zurich, London, and Amsterdam.

Governments and educational institutions are beginning to respond. In Germany, the Federal Ministry of Education and Research and various universities are expanding interdisciplinary programs in fintech, digital law, and data science, while professional associations develop specialized certifications in compliance and RegTech. Internationally, business schools in the United States, United Kingdom, France, Singapore, and Australia are also integrating regulatory technology and digital finance modules into their curricula, reflecting global demand. For those exploring career paths or hiring strategies, FinanceTechX Education and FinanceTechX Jobs provide a window into how the skills market is evolving.

RegTech and AI-Driven Compliance: Enabler and Risk Factor

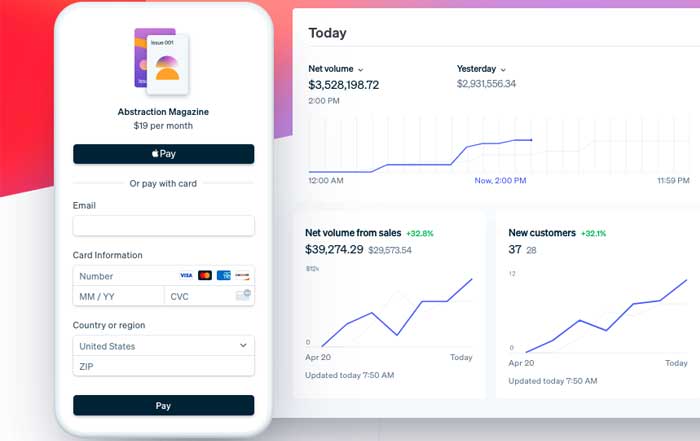

The rise of RegTech has been one of the most consequential developments for fintechs seeking to cope with mounting regulatory obligations. Companies such as IDnow, ComplyAdvantage, and Fourthline offer tools for digital identity verification, sanctions screening, transaction monitoring, regulatory reporting, and risk analytics, often powered by machine learning and cloud-native architectures. These solutions can significantly reduce manual workload, improve detection quality, and generate the audit trails that supervisors increasingly expect.

However, regulators in Germany and the EU have made it clear that outsourcing compliance functions does not transfer legal responsibility. Firms must conduct due diligence on their RegTech providers, ensure that algorithms are explainable and free of prohibited biases, and maintain sufficient in-house expertise to challenge and oversee automated systems. BaFin and European authorities have warned against "black box" solutions where neither the institution nor the supervisor can fully understand how key decisions are made. This is particularly sensitive in areas such as credit underwriting, AML alerts, and fraud detection, where errors or biases can have severe consequences for individuals and financial stability.

For readers on FinanceTechX AI and FinanceTechX Security, the emerging best practice is clear: treat RegTech not as a plug-and-play fix but as a strategic capability that must be integrated into governance, risk, and compliance frameworks from the outset.

Sustainability, Green Fintech, and ESG Regulation

Another dimension of regulatory evolution affecting German and European fintechs is the surge in sustainability-related rules. The EU Sustainable Finance Disclosure Regulation (SFDR), the EU Taxonomy Regulation, and emerging corporate sustainability reporting standards require financial institutions to collect, process, and disclose detailed environmental, social, and governance (ESG) data. For fintechs operating in wealth management, lending, and payments, this creates both new obligations and significant business opportunities.

Green fintechs are developing tools for carbon footprint tracking, sustainable investment selection, and climate risk analytics, serving clients from Scandinavia to Asia-Pacific and North America. Regulators and standard-setting bodies such as the European Environment Agency and the International Sustainability Standards Board provide frameworks that these solutions must align with. For readers interested in the convergence of finance, technology, and climate action, FinanceTechX Environment and FinanceTechX Green Fintech highlight how German and EU rules are positioning the region as a leader in sustainable digital finance.

Strategic Outlook: Turning Regulatory Burden into Competitive Advantage

By 2026, it is evident that fintech success in Germany and the EU is no longer defined solely by speed, user experience, or capital efficiency. Experience, expertise, authoritativeness, and trustworthiness have become central differentiators, particularly in a world where institutional clients, regulators, and consumers are acutely aware of operational, cyber, and conduct risks. For the global audience of FinanceTechX, the European case illustrates how a demanding regulatory environment can, over time, create a high-trust market that rewards well-governed, resilient firms.

To thrive in this context, leading German and European fintechs are adopting several strategic principles. They are integrating compliance into product design from the earliest stages, ensuring that licensing, data protection, and AML considerations shape architectures rather than being retrofitted under pressure. They are investing in in-house regulatory expertise and building constructive relationships with supervisors, participating in consultations, industry associations, and innovation hubs to help shape future rules. They are leveraging RegTech and AI judiciously, focusing on transparency, explainability, and robust vendor governance. They are aligning with EU-wide harmonization efforts, treating frameworks such as MiCA, DORA, and the forthcoming AMLA regime not only as constraints but as enablers of cross-border scale. And they are exploring new opportunities created by sustainability regulation, the digital euro, and tokenization to differentiate their offerings in a crowded market.

For policymakers, supervisors, and industry leaders, the German and EU experience offers a blueprint for how to manage the next phase of fintech evolution worldwide. The balance between innovation and oversight will remain contested, especially as AI, DeFi, and quantum-safe cryptography challenge existing paradigms. Yet the direction of travel is clear: in a world increasingly defined by digital interdependence and systemic risk, the ability to build trustworthy, well-regulated, and resilient financial technology will be a decisive competitive advantage for firms, ecosystems, and regions alike. Readers can continue to follow these developments across fintech, banking, markets, and policy on FinanceTechX's global coverage and its dedicated sections for fintech, economy, banking, and the stock exchange, where the interplay of regulation and innovation will remain a defining theme of the decade.