Digital Finance and the Next Wave of Global Trade Growth

Digital Finance at the Center of a Rewired Trading System

By 2026, global trade has entered a new phase in which digital finance is no longer a peripheral enabler but a structural component of how cross-border business is conceived, executed and scaled. Across North America, Europe, Asia, Africa and Latin America, digital tools now sit at the junction of buyers, suppliers, logistics providers, banks, fintech platforms and regulators, creating a dense fabric of data and financial flows that underpins modern trade. For the global audience of FinanceTechX, which includes founders, institutional investors, corporate leaders and policymakers from markets such as the United States, the United Kingdom, Germany, Singapore and Brazil, this transformation is not simply an innovation story; it is a question of competitiveness, resilience and strategic positioning in an era defined by geopolitical fragmentation, supply-chain realignment and accelerating technological change.

As trade volumes recover from the pandemic era and adjust to shifting production hubs, nearshoring and friend-shoring, the ability to integrate digital finance into trade operations has become a decisive differentiator. Companies that can orchestrate real-time payments, digital documentation, data-driven credit and embedded risk management are better placed to enter new markets, manage volatility and respond to regulatory change. The evolution of trade rules around digital commerce, highlighted by institutions such as the World Trade Organization, shows how digital finance is increasingly recognized as a core infrastructure for cross-border activity. Those seeking deeper context on the policy environment can review how global rules on digital trade and e-commerce are evolving through resources on digital trade and e-commerce, which outline how secure data flows and interoperable standards underpin this new trading architecture.

For FinanceTechX, which covers the intersection of fintech, business strategy, world economy and AI innovation, the central question in 2026 is how leaders can convert digital finance capabilities into sustainable competitive advantage in global trade, while maintaining trust, security and regulatory alignment across jurisdictions as diverse as the United States, China, the European Union, Singapore, South Africa and Brazil.

From Paper to Platforms: Structural Transformation in Trade Finance

The long-standing reliance on paper-based instruments, manual workflows and bilateral banking arrangements has given way to platform-based, data-driven models of trade finance that are reshaping the economics of cross-border commerce. Letters of credit and documentary collections remain part of the toolkit, but they increasingly exist as digital constructs embedded in platforms rather than as physical documents moving between counterparties and correspondent banks. This transformation has been accelerated by regulatory modernization and the recognition by bodies such as UNCITRAL that legal certainty for electronic transferable records is essential if trade finance is to fully digitize. The UNCITRAL Model Law on Electronic Transferable Records has provided a reference for jurisdictions from Europe and Asia to the Middle East and Africa, enabling digital bills of lading, promissory notes and warehouse receipts to carry the same legal weight as their paper predecessors, and those interested in the legal foundations can explore UNCITRAL's work on electronic commerce to understand how harmonization supports cross-border trade.

In parallel, standard-setting organizations such as SWIFT and the International Chamber of Commerce have advanced common data models and messaging standards that enable banks, corporates and fintech platforms to exchange information consistently and securely. This has laid the groundwork for interoperable trade platforms that connect participants across continents, reducing processing times from weeks to days or even hours and sharply lowering operational risk. The convergence of these standards with open banking initiatives in markets like the United Kingdom, the European Union and Australia has further enabled third-party providers to embed financing, risk mitigation and compliance into digital trade journeys, making digital finance the default infrastructure for cross-border transactions rather than an optional overlay.

Embedded Finance and the Platformization of Global Trade

One of the most consequential developments since 2020 has been the rise of embedded finance within trade and supply-chain platforms, as financial services are integrated directly into the software environments where sourcing, procurement, logistics and cross-border sales are managed. Leading B2B marketplaces in the United States and Europe, as well as super-apps and regional trade hubs in Asia and Africa, now offer credit, insurance, payments and foreign-exchange services at the point of need, effectively turning trade platforms into full-stack financial ecosystems. Businesses can access working capital when they confirm an order, insure a shipment with a single digital interaction, or automatically hedge currency exposures as soon as a contract is executed, without leaving the primary platform on which they operate.

This "platformization" of trade is changing how companies in markets from Germany and the Netherlands to Singapore and South Korea think about their financial relationships. Instead of dealing with multiple banks and intermediaries in sequential processes, they increasingly interact with orchestrated ecosystems where banks, non-bank lenders, insurers and logistics providers are integrated through APIs. Research from institutions such as McKinsey & Company on the future of payments illustrates how embedded services are redefining customer expectations and compressing value chains, with implications for incumbents and challengers alike. For the FinanceTechX readership, many of whom are founders building new trade and payment platforms or executives rearchitecting legacy infrastructure, this shift underscores the need to treat financial services as a core design element of digital trade ecosystems, not a back-office function.

Democratizing Access: SMEs and Cross-Border Inclusion

The global trade finance gap for small and medium-sized enterprises has long been recognized as a barrier to inclusive growth, particularly in emerging markets across Africa, South Asia and Latin America, but also for exporters in Europe and North America that lack scale. Traditional risk assessment techniques, collateral requirements and documentation standards have historically excluded many SMEs from accessing trade finance, even when they are integrated into global value chains. Digital finance is now addressing this structural challenge by leveraging alternative data sources, automated underwriting and digital identity tools to construct more accurate and inclusive credit profiles.

Fintech platforms in markets such as India, Indonesia, Nigeria, Mexico and Brazil are using transaction histories from e-commerce platforms, logistics providers and digital payment systems to gauge SME performance in real time, enabling dynamic credit lines that grow with the business. Organizations such as the International Finance Corporation have highlighted the importance of such innovations in narrowing the SME finance gap, and those seeking to understand the scale of this issue can review its analysis of SME finance. Within the FinanceTechX community, founders are increasingly building products that blend trade finance, invoice discounting and supply-chain analytics into unified offerings, allowing smaller firms in countries from Italy and Spain to Kenya and Vietnam to participate more fully in cross-border trade. This democratization of access is not only a matter of social and economic inclusion; it also expands the addressable market for banks, investors and platform operators who can effectively serve this previously underfinanced segment.

Real-Time Payments, FX Innovation and Liquidity Optimization

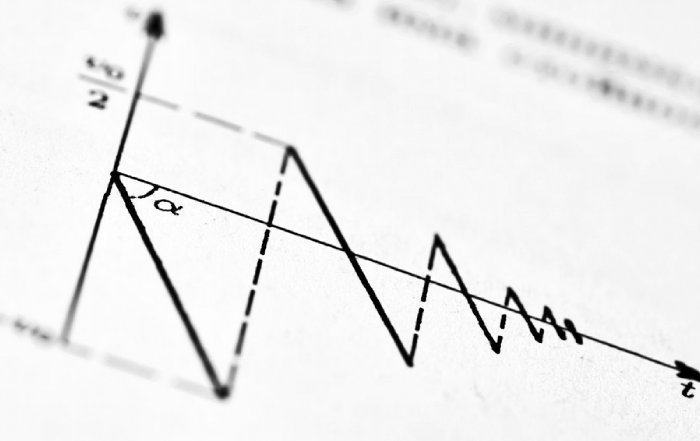

The proliferation of real-time payment systems and the maturation of digital foreign-exchange solutions are changing the tempo and risk profile of global trade. In the United States, the Federal Reserve's FedNow Service has added a domestic instant payment rail that complements private-sector solutions, while in Europe, instant SEPA schemes and initiatives driven by the European Central Bank are enabling near-immediate euro transfers across borders within the bloc. In Asia, countries such as Singapore, Thailand and India are linking their fast payment systems to support cross-border retail and SME flows, and similar initiatives are emerging in other regions. The Bank for International Settlements provides a comprehensive overview of these developments in its work on fast payment systems, illustrating how instant settlement can reduce counterparty risk, improve cash-flow visibility and support more agile supply-chain finance structures.

At the same time, FX volatility remains a central concern for exporters and importers in markets as diverse as the United Kingdom, Japan, South Africa and Brazil. Digital finance is responding with multi-currency wallets, automated hedging tools and integrated FX management capabilities that allow businesses to lock in rates, set exposure limits and manage liquidity across currencies from a single interface. These capabilities are increasingly embedded directly into enterprise resource planning systems, treasury platforms and trade marketplaces, enabling finance teams to move from reactive to proactive management of global cash positions. For readers of FinanceTechX, especially those engaged in stock-exchange and capital-markets activity, the convergence of real-time payments, FX innovation and data-driven liquidity forecasting is becoming a strategic lever for supporting expansion into new regions while maintaining disciplined capital allocation.

Central Banks, Regulation and the Rise of Digital Currencies

The policy and regulatory environment around digital money has become a central determinant of how digital finance supports global trade. Central banks and regulators across the United States, the Eurozone, the United Kingdom, China, Singapore and beyond are examining how central bank digital currencies and tokenized deposits could reshape cross-border payments, correspondent banking and settlement. Institutions such as the International Monetary Fund have played a coordinating role in analyzing the macro-financial implications of these innovations, and those seeking a policy-level understanding can refer to the IMF's resources on digital money and fintech, which cover design choices, risk considerations and potential use cases.

In Asia, the Monetary Authority of Singapore has been at the forefront of multi-CBDC and wholesale digital currency experiments aimed at enhancing cross-border settlement efficiency, while the Bank of England and the European Central Bank continue to explore digital euro and digital pound concepts with a cautious, consultative approach. Meanwhile, the tokenization of trade-related assets such as invoices, receivables and inventory is moving from proof-of-concept to early commercialization in regions including Europe, the Middle East and parts of Asia, supported by clearer regulatory frameworks for digital asset custody and market infrastructure. The Financial Stability Board has provided important guidance on systemic risk and supervisory approaches in its work on crypto-asset regulation, helping shape how jurisdictions from Switzerland and Singapore to Canada and the United States approach digital asset markets. For FinanceTechX, whose coverage of crypto and digital assets emphasizes institutional adoption and regulatory clarity, the key question is how programmable money and tokenized collateral will be integrated into mainstream trade finance without compromising stability or compliance.

Data, AI and Cross-Border Risk Management

Artificial intelligence and advanced analytics have become indispensable in managing the complexity of modern trade, where financial flows intersect with geopolitical risk, supply-chain vulnerabilities, sanctions regimes and evolving ESG expectations. Financial institutions, corporates and fintech providers are deploying AI models to process vast streams of structured and unstructured data, from customs records and shipping manifests to satellite imagery, climate indicators and macroeconomic trends, in order to generate more accurate credit assessments, detect fraud and anticipate disruptions. The OECD has examined these developments in its work on AI in finance, highlighting both the efficiency gains and the governance challenges associated with algorithmic decision-making.

Within the FinanceTechX audience, there is particular focus on how AI can support compliance with increasingly complex regulatory obligations in areas such as sanctions, anti-money-laundering, export controls and data protection. Machine learning-driven transaction monitoring tools can identify anomalous patterns in payment flows and trade documentation, while natural language processing can assist in screening counterparties against evolving sanctions lists and adverse-media sources. At the same time, AI is being used to refine pricing and structuring of trade credit and insurance by incorporating granular risk factors, including sector-specific trends and climate-related hazards that may affect production in countries like Thailand, Vietnam or Brazil. The World Economic Forum has explored the broader macroeconomic implications of AI in its analysis of AI and the global economy, underscoring the need for robust governance frameworks to ensure that AI-driven trade finance remains fair, transparent and resilient.

Sustainability, Green Trade and the ESG Imperative

The integration of environmental, social and governance considerations into trade and finance has moved from a niche concern to a central strategic priority, particularly for companies operating in jurisdictions such as the European Union, the United Kingdom, Canada and the Nordics, where regulatory requirements and investor expectations are especially stringent. Digital finance is critical to this shift because it enables the collection, verification and reporting of ESG metrics across complex, multi-tier supply chains that span regions from Asia and Africa to South America and Eastern Europe. The European Union's Corporate Sustainability Reporting Directive and sustainable finance taxonomy are driving companies to embed ESG data collection into their operational and financial systems, and the European Commission's guidance on sustainable finance provides a roadmap for aligning capital flows with climate and environmental objectives.

For FinanceTechX, which devotes dedicated coverage to green fintech and sustainability and environmental innovation, the link between digital finance and sustainable trade is particularly salient. Green trade finance products, such as sustainability-linked supply-chain finance or preferential pricing for low-carbon logistics, rely on digital platforms that can ingest and validate emissions data, energy usage and social impact indicators in near real time. Frameworks such as those developed by the Task Force on Climate-related Financial Disclosures have set expectations for climate risk reporting, while organizations like the International Trade Centre provide practical guidance on green trade and climate, helping exporters and importers in regions from Africa and South America to Asia adapt to low-carbon trade requirements. As border adjustment mechanisms and product-level carbon disclosures become more common, digital finance solutions that can link financing terms to verified ESG performance will be essential for maintaining market access and investor confidence.

Regional Dynamics in a Multipolar Digital Trade Landscape

Although digital finance is a global phenomenon, its adoption and impact on trade are shaped by regional characteristics ranging from regulatory regimes and infrastructure maturity to cultural attitudes toward technology and risk. In North America and Western Europe, the emphasis has often been on upgrading legacy systems, implementing open banking frameworks and enhancing regulatory oversight of fintech innovation. The European Banking Authority has been instrumental in setting supervisory expectations for digital finance, and its work on fintech and innovation offers insight into how the EU balances innovation with consumer protection and financial stability. In these markets, corporates and banks are using digital tools to streamline established trade corridors, particularly transatlantic and intra-European flows, while exploring new opportunities in fast-growing regions of Asia, Africa and Latin America.

In Asia, the landscape is characterized by rapid innovation, strong state support for digital infrastructure and the prominence of large platform ecosystems. China's cross-border e-commerce giants, Singapore's role as a regional fintech hub and South Korea's advanced digital payment systems exemplify this dynamic, as do emerging initiatives in Southeast Asian economies such as Malaysia, Thailand and Indonesia. In Africa, mobile money and digital wallets have dramatically expanded financial inclusion in countries like Kenya, Ghana and Tanzania, creating new pathways for SMEs to engage in regional and global trade, even as infrastructure and regulatory challenges persist. Latin America, led by markets such as Brazil, Mexico and Colombia, has seen a surge in fintech innovation that is reshaping both domestic and cross-border payment and credit landscapes. For readers following FinanceTechX's world and economy coverage, resources from organizations such as the World Bank on digital trade and development provide comparative perspectives that can inform decisions on market entry, partnership and investment across these diverse regions.

Security, Resilience and Trust in a Fully Digital Trade Ecosystem

As trade and finance become increasingly digitized, the importance of cybersecurity, data protection and operational resilience has grown commensurately. Financial flows, trade documents, customs records and supply-chain data are now prime targets for cybercriminals and state-sponsored actors, and any breach can have cascading effects across multiple jurisdictions and sectors. To sustain confidence in digital trade, organizations must invest in robust security architectures, encryption, identity verification frameworks and incident-response capabilities that align with best practices and regulatory expectations. The National Institute of Standards and Technology has played a central role in defining such practices through its cybersecurity framework, which is widely referenced by financial institutions and technology providers across North America, Europe and Asia.

For the FinanceTechX audience, which follows developments in banking, security and AI-driven risk management, trust is understood as the foundational currency of digital trade. Secure digital identities, strong authentication and tamper-resistant records are essential for preventing fraud and ensuring the integrity of digital documents such as electronic bills of lading and guarantees. At the same time, resilience extends beyond cybersecurity to include redundancy in payment networks, cloud infrastructure and data centers, as well as contingency planning for geopolitical shocks, pandemics and climate-related disruptions that can affect trade routes and production hubs in regions ranging from East Asia and Europe to Southern Africa and South America. Organizations that bake resilience into their digital finance strategies are better equipped to maintain operations and support partners during periods of volatility, strengthening their position in global supply chains.

Talent, Education and the Future Workforce of Digital Trade

The rapid integration of technology into trade and finance is fundamentally reshaping workforce requirements. Professionals in banking, logistics, compliance and corporate finance now need to navigate APIs, data analytics, AI models, cybersecurity principles and ESG frameworks alongside traditional trade instruments and regulatory rules. Universities, business schools and professional bodies in countries such as the United States, the United Kingdom, Germany, Singapore and Australia are redesigning curricula to reflect these interdisciplinary demands, while forward-looking organizations are investing in continuous learning and internal mobility to keep pace with change. The World Economic Forum has documented these shifts in its analysis of the future of jobs and skills, highlighting the growing demand for digital literacy, analytical capabilities and sustainability expertise across sectors.

For FinanceTechX, which maintains a focus on education and jobs and careers, the talent dimension is central to the long-term viability of digital trade ecosystems. Founders and executives across fintech, banking, logistics and technology in markets from Canada and France to South Korea and South Africa increasingly seek hybrid profiles that combine financial acumen with software engineering, data science and regulatory insight. Policymakers and development agencies recognize that digital trade and finance can be powerful engines of employment, particularly for younger populations in emerging economies, but only if education and training systems are aligned with market needs and accessible to diverse communities. As AI automates routine tasks in trade finance and operations, human roles are shifting toward higher-value activities such as relationship management, complex risk assessment, product design and governance, further elevating the importance of continuous reskilling.

The Strategic Agenda for Leaders in 2026 and Beyond

By 2026, digital finance has firmly established itself as a core pillar of global trade, enabling faster, more transparent and more inclusive cross-border commerce while introducing new layers of complexity that leaders must manage responsibly. For the international audience of FinanceTechX, spanning corporates, banks, fintech founders, investors and policymakers across North America, Europe, Asia, Africa and South America, the strategic imperative is to harness digital finance as a driver of growth and resilience, without losing sight of security, governance and societal impact. This requires not only deploying advanced technology but also rethinking operating models, risk frameworks and partnership strategies to reflect a reality in which trade is conducted through interconnected digital platforms rather than linear, paper-based processes.

Organizations that actively monitor developments across fintech innovation, global business models, crypto and tokenization, macroeconomic trends and regulatory news and policy shifts will be better positioned to anticipate change and capture emerging opportunities. The next decade of global trade will be shaped by how effectively leaders integrate digital finance into their strategies, from embedded credit and real-time payments to AI-driven risk management and green trade finance. Those who invest early in robust digital infrastructure, trusted partnerships, skilled talent and resilient governance frameworks will not only navigate the uncertainties of a multipolar world but also help define the standards and practices that underpin the next generation of global commerce.