The 2026 Outlook for Professional Coworking: How Flexible Workspaces Became a Core Asset Class

Coworking's Maturity Moment in 2026

By 2026, professional coworking has moved decisively from experimental trend to structural pillar of the global economy. What began two decades ago as a grassroots response to freelancers' need for affordable, flexible desks has matured into a sophisticated ecosystem that now shapes corporate real estate strategies, investor portfolios, urban policy, and even national competitiveness. For the audience of FinanceTechX at financetechx.com, which tracks the intersection of fintech, business, global markets, and transformative technologies, coworking is no longer simply about where people work; it is about how capital, technology, and talent are being reallocated across borders and sectors.

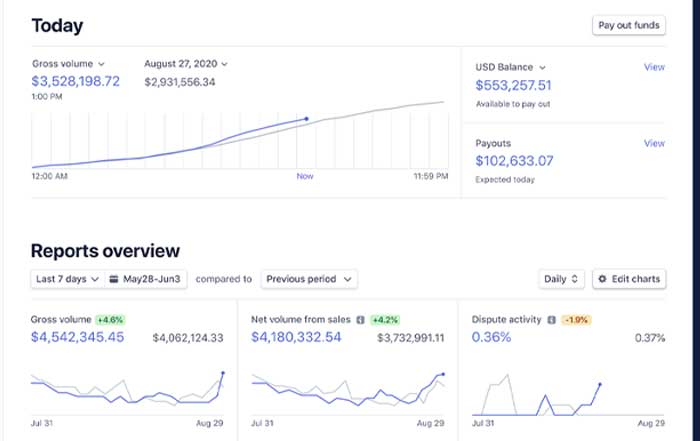

Global market estimates now place the professional coworking sector above the USD 45-50 billion threshold in annual revenues in 2026, with compounding growth still outpacing traditional office real estate in most major economies. This value reflects not only membership fees and corporate leases, but also a growing stack of ancillary revenue streams-from digital services and enterprise solutions to fintech-enabled payment systems and data-driven insights. Learn more about how these trends sit within the broader business environment that FinanceTechX covers globally.

From Counterculture Offices to Institutional Infrastructure

The evolution of coworking has been shaped by successive waves of technology, culture, and capital. Early pioneers in cities like San Francisco, London, and Berlin offered open-plan spaces and community events geared toward designers, developers, and early-stage founders. As cloud computing, collaboration software, and high-speed connectivity reduced the need for fixed corporate offices, these spaces became natural homes for startups and independent professionals.

The entry of major operators such as WeWork, IWG (Regus and Spaces), and Industrious transformed this fragmented landscape into a recognizable global industry. Backed by venture capital and private equity, they standardized design, layered in hospitality-style services, and negotiated large-scale leases with landlords. By the late 2010s, coworking had become synonymous with innovation districts from New York's Midtown and San Francisco's SoMa to Berlin's Mitte and Singapore's central business district.

The COVID-19 pandemic and the subsequent normalization of hybrid work accelerated this trajectory. As corporations in the United States, Europe, and Asia reassessed long-term leases and occupancy levels, professional coworking emerged as a strategic tool for de-risking real estate commitments. In 2026, enterprise clients represent a substantial portion of revenue for leading operators, while institutional investors increasingly treat coworking as a durable, cash-generating asset class. Readers can place this within broader global economy dynamics, where flexibility and capital efficiency now dominate strategic planning.

Market Value and Regional Distribution in 2026

The global market for professional coworking has crossed a critical inflection point. Analysts now estimate annual revenues in excess of USD 45 billion, with mid-teens compound annual growth rates forecast through the end of the decade in high-growth regions such as Asia-Pacific, the Middle East, and parts of Africa and Latin America. Mature markets in North America and Western Europe continue to expand, though at a more measured pace, as operators focus on profitability, operational efficiency, and deeper integration with corporate real estate.

The United States remains the single largest national market, accounting for roughly one-third of global coworking revenues, supported by strong adoption among technology, financial services, and professional services firms. The United Kingdom, Germany, and France anchor European demand, while Canada and Australia have become important secondary hubs with high penetration of hybrid work and startup ecosystems. In Asia, Singapore, Japan, South Korea, and China host increasingly sophisticated coworking offerings targeted at multinational corporations and scale-ups.

Emerging markets are now central to the growth narrative. Cities such as São Paulo, Mexico City, Nairobi, Lagos, Bangkok, and Johannesburg are seeing rapid expansion of flexible workspaces that blend entrepreneurship, digital finance, and cross-border collaboration. These markets underscore how coworking is not just a Western phenomenon but a global infrastructure layer supporting new forms of employment and capital formation. For a broader lens on regional developments, readers can explore FinanceTechX's global world and markets coverage.

Fintech, Payments, and the Digital Backbone of Coworking

The rise in coworking's market value is inseparable from the integration of financial technology and digital infrastructure. Modern operators are effectively running technology platforms as much as they are managing physical spaces. Membership management, billing, access control, and meeting-room reservations are now handled through cloud-based systems that integrate with accounting tools, customer relationship management platforms, and enterprise security solutions.

Fintech has enabled operators to move beyond simple monthly invoices toward sophisticated, usage-based pricing and dynamic membership tiers. In markets like the United States, Stripe, Adyen, and other payment processors power recurring billing and multi-currency transactions, while in Europe and Asia, open banking frameworks and instant payment rails support real-time settlement. Learn more about how these technologies intersect with workspace models through FinanceTechX's dedicated fintech insights.

Crypto and blockchain applications, while still niche, have gained traction in regulatory-friendly jurisdictions such as Switzerland and Singapore. Some operators accept stablecoins as payment for memberships, while others experiment with tokenized loyalty programs and blockchain-based access credentials. Smart contracts are increasingly explored for automating revenue-sharing agreements between landlords and operators, reducing administrative friction and enhancing transparency. Those following the evolution of digital assets can deepen their understanding via FinanceTechX's coverage of crypto and digital assets.

North America: From Experimentation to Portfolio Staple

In North America, coworking has become firmly embedded in corporate real estate strategies. New York, San Francisco, Los Angeles, Toronto, and Vancouver host dense networks of professional coworking spaces serving technology companies, financial institutions, legal practices, and creative industries. The region's high office rents, volatile macroeconomic environment, and strong culture of entrepreneurialism have all contributed to sustained demand.

WeWork's post-crisis reinvention, Industrious's hospitality-led model, and a growing cohort of regional operators have collectively shifted the narrative from speculative growth to disciplined, service-driven operations. Landlords and real estate investment trusts now frequently structure management agreements or revenue-sharing partnerships with coworking brands, treating them as operating partners rather than simple tenants. This arrangement is increasingly visible in U.S. and Canadian markets, where institutional capital from pension funds and insurance companies flows into flexible workspace platforms as part of diversified real estate allocations. For those tracking financial-sector implications, FinanceTechX's banking and financial sector analysis provides relevant context.

Europe: Diversity, Design, and ESG-Driven Growth

Europe's coworking landscape is characterized by diversity in both operators and customer segments. IWG, headquartered in Switzerland, remains the dominant pan-European player, with an extensive footprint from London and Paris to Berlin, Madrid, Rome, and Amsterdam. Alongside these global brands, a rich layer of local and regional operators has emerged, often targeting specific verticals such as legal services, deep-tech startups, or creative industries.

European coworking growth is tightly linked to environmental, social, and governance (ESG) priorities and urban regeneration strategies. Many spaces are located in repurposed industrial buildings or mixed-use developments, reflecting broader efforts to revitalize city centers and reduce commuting-related emissions. Governments and municipal authorities in the United Kingdom, Germany, France, Italy, Spain, and the Nordic countries increasingly view coworking hubs as catalysts for innovation clusters and SME development. Those interested in how these developments align with European business strategy and policy can explore FinanceTechX's world and regional coverage.

Asia-Pacific: High-Growth, High-Tech Hubs

The Asia-Pacific region is now one of the most dynamic arenas for coworking innovation. In Singapore, flexible workspaces are closely integrated with fintech, wealth management, and Web3 ecosystems, offering founders and investors proximity to regulators, financial institutions, and global capital. Tokyo and Osaka are seeing a gradual but meaningful cultural shift as large Japanese corporations adopt hybrid models and satellite coworking memberships for employees who prefer shorter commutes and more collaborative environments.

Seoul has positioned coworking as part of its broader smart city and digital innovation agenda, while Hong Kong continues to leverage coworking as an interface between mainland China and global markets. In emerging Southeast Asian markets such as Thailand, Malaysia, Indonesia, and Vietnam, coworking spaces serve as anchors for startup ecosystems and digital nomad communities, often in tandem with new visa regimes that encourage mobile professionals. FinanceTechX's AI and digital transformation coverage sheds light on how artificial intelligence and automation are accelerating these regional shifts.

Middle East and Africa: Innovation Platforms and Market Gateways

In the Middle East, professional coworking has become intertwined with national diversification strategies. Dubai, Abu Dhabi, Riyadh, and Doha host high-specification coworking centers embedded in innovation districts, free zones, and financial centers. Governments and sovereign wealth funds often partner with global and regional operators to attract international startups, venture capital, and technology companies, positioning coworking as a soft-landing platform for foreign market entry.

Across Africa, coworking remains at an earlier stage of development but is rapidly gaining momentum. Cities such as Nairobi, Lagos, Cape Town, and Johannesburg rely on flexible workspaces as multipurpose hubs that combine office space, startup incubation, skills training, and access to fintech solutions such as mobile payments and digital lending. For FinanceTechX readers tracking frontier and emerging markets, the world economy section provides additional analysis on how these hubs are reshaping regional opportunity.

Latin America: Entrepreneurial Energy and Hybrid Urbanism

Latin America's coworking growth is closely tied to its vibrant entrepreneurial culture and the rapid expansion of the digital economy. São Paulo, Rio de Janeiro, Mexico City, Bogotá, Buenos Aires, and Santiago now feature mature coworking ecosystems that serve as meeting points for founders, investors, and multinational corporations. Economic volatility and currency fluctuations have made flexible leases and capital-light workspace solutions particularly attractive for both local companies and global firms entering the region.

Many Latin American operators integrate coworking with coliving, education, and community programs, creating multi-use environments that reflect the region's dense urbanism and strong social networks. FinanceTechX's news and market coverage offers further context on how macroeconomic conditions influence workspace and startup formation trends across the region.

How Investors Now Value Coworking Platforms

The re-rating of coworking from speculative venture story to recognized asset class has reshaped investor behavior. Institutional investors and real estate funds now examine coworking operators using metrics that blend hospitality, technology, and property fundamentals. Occupancy rates, average revenue per member, contract duration, churn, and enterprise share of revenue are evaluated alongside digital engagement, platform scalability, and brand strength.

Public markets increasingly understand flexible workspace as part of a broader "office-as-a-service" category, comparable in some respects to subscription-based software or managed services. Real estate investment trusts and listed property companies partner with or acquire coworking operators to defend asset values and maintain occupancy in an era of hybrid work. Readers interested in how this plays out in capital markets can explore FinanceTechX's stock exchange insights.

At the same time, venture capital continues to back new coworking models, particularly those integrating deep tech, AI, or sector-specific verticalization. In markets such as India, Singapore, and China, investors support platforms that combine workspace with startup acceleration, education, and cross-border deal-making. This is closely aligned with the founder and innovation narratives covered in FinanceTechX's founders section.

Sustainability, ESG, and the Green Coworking Premium

Sustainability has evolved from a differentiator into a core requirement for professional coworking operators, especially in Europe, North America, and advanced Asian markets. Many leading brands now pursue LEED, BREEAM, or comparable green building certifications, and are integrating energy-efficient HVAC systems, low-carbon materials, and advanced air-quality monitoring into both new and retrofitted locations. These environmental attributes are no longer purely marketing features; they directly influence leasing decisions by corporate clients under pressure to meet ESG targets.

Biophilic design-using natural light, plants, and organic materials-has become central to wellness-oriented coworking environments that seek to reduce stress, improve concentration, and align with employers' health strategies. Net-zero commitments and carbon accounting tools are increasingly embedded into operator roadmaps, with some platforms publishing annual sustainability reports aligned to UN Sustainable Development Goals. FinanceTechX readers can learn more about the intersection of sustainability, finance, and infrastructure through the site's environment and business insights and dedicated green fintech coverage.

Investors now routinely factor ESG performance into valuation models, rewarding operators that demonstrate measurable reductions in energy consumption, waste, and emissions. This "green coworking premium" is particularly pronounced in markets like the Nordics, Germany, the United Kingdom, and Singapore, where regulatory regimes and investor expectations are advancing rapidly.

AI, Smart Buildings, and Data-Driven Operations

Artificial intelligence and data analytics are redefining how coworking spaces are designed, priced, and managed. Internet of Things (IoT) sensors monitor occupancy, temperature, lighting, and air quality in real time, enabling operators to optimize layouts, adjust climate control dynamically, and reduce energy expenditure. AI-driven algorithms analyze usage patterns to refine membership tiers, forecast demand, and tailor services to different customer segments.

For members, integrated mobile apps have become the primary interface with the workspace, handling access control, room bookings, billing, and support requests. These apps increasingly incorporate AI-based recommendations, suggesting events, introductions, or services that align with a member's profile and behavior. For FinanceTechX readers focused on AI's role in operational efficiency and customer experience, the AI insights section provides additional depth.

On the security side, biometric access, behavior-based anomaly detection, and zero-trust network architectures are becoming standard in higher-end enterprise-focused locations. This is critical as more sensitive work-including financial transactions, legal matters, and R&D-is conducted from shared environments. FinanceTechX's security coverage highlights how cyber and physical security frameworks are converging in such digitally intensive spaces.

Hybrid Work as the Default and the Rise of Distributed Networks

By 2026, hybrid work has become the default model in knowledge-based industries across North America, Europe, and advanced Asian economies. Employees in the United States, the United Kingdom, Germany, Canada, Australia, and the Nordics increasingly expect a mix of home, office, and third-space options. Coworking networks provide the physical backbone for this distributed model, offering standardized quality and services across multiple cities and, in some cases, continents.

Corporations now negotiate portfolio-level agreements with major coworking operators, granting employees access to a specified number of locations near their homes or client sites. This arrangement reduces the need for expensive central headquarters space while maintaining brand cohesion and professional standards. It also expands the effective labor market, enabling companies to recruit in secondary cities and smaller countries without committing to standalone offices. Those tracking labor-market and workplace dynamics can explore FinanceTechX's jobs and careers analysis.

This distributed network model is particularly important for organizations with global footprints spanning North America, Europe, and Asia-Pacific, as well as for companies operating in fast-growing markets such as Brazil, South Africa, and Southeast Asia, where flexible hubs allow for agile market entry and scaling.

Education, Skills, and the Coworking-Learning Nexus

Coworking spaces are increasingly intersecting with education and workforce development. Many operators host coding bootcamps, fintech academies, executive education programs, and continuous learning initiatives in partnership with universities, business schools, and private training providers. This trend reflects a broader shift toward lifelong learning and the need for constant upskilling in fields such as data science, cybersecurity, AI, and digital finance.

For FinanceTechX readers following the future of education and work, the site's education coverage offers additional context on how learning ecosystems are being embedded into physical and digital work environments. In markets from the United States and the United Kingdom to Singapore and South Korea, coworking campuses now serve as hybrid spaces where people work, study, and build professional networks simultaneously.

Strategic Implications for Leaders and Founders

For business leaders, founders, and policymakers, the maturation of coworking into a multi-billion-dollar global industry carries several strategic implications. Corporates must now treat flexible workspace not as a marginal perk, but as a core component of talent, real estate, and risk management strategies. Founders and fast-growing startups can use coworking to scale across geographies quickly, tapping into local ecosystems without the capital burden of traditional leases. Policymakers in Europe, Asia, Africa, and the Americas can leverage coworking hubs as anchors for innovation districts, SME development, and inward investment.

At the same time, the sector's growth brings new complexities: operator consolidation, varied regulatory regimes, cybersecurity requirements, and the need to balance community-building with operational rigor. FinanceTechX, through its coverage of business, founders, economy, and news, continues to examine these trade-offs and opportunities for decision-makers.

Coworking as an Expression of the Future Economy

In 2026, professional coworking spaces stand as tangible expressions of deeper economic, technological, and cultural shifts. They encapsulate the move from fixed to flexible capital allocation, from lifetime employment to portfolio careers, from siloed offices to networked ecosystems, and from carbon-intensive infrastructure to more sustainable, data-driven environments. For FinanceTechX's global audience-from the United States and Europe to Asia, Africa, and South America-coworking is a lens through which to understand how fintech, AI, and green finance converge in real, operational settings.

As the sector's market value climbs and its influence spreads into secondary cities, emerging markets, and new industry verticals, coworking is no longer simply about desks and meeting rooms. It is about building resilient, adaptive systems that can support innovation, entrepreneurship, and inclusive growth in a world defined by uncertainty and rapid technological change. In that sense, the story of coworking is inseparable from the story that FinanceTechX tells every day: how finance and technology are reshaping the way people work, build companies, and create value across a truly global economy.