Denmark's Next-Generation Finance Software: A Strategic Blueprint for Global Fintech in 2026

Denmark's trajectory in digital finance has moved from quiet Nordic success story to global reference point, and by 2026 it stands as one of the clearest examples of how a small, highly coordinated economy can use next-generation finance software to punch far above its weight. For the audience of FinanceTechX, which follows developments across fintech, banking, artificial intelligence, crypto, green finance, and the broader global economy, Denmark's experience offers a practical and strategic blueprint: it shows how digital identity, open banking, advanced analytics, and sustainability can be woven together into a coherent national fintech strategy that is commercially competitive, socially trusted, and environmentally aligned. In an era when financial systems from the United States and the United Kingdom to Singapore and Brazil are being reshaped by software, Denmark illustrates how careful institutional design, strong regulatory capacity, and a culture of digital adoption can create lasting competitive advantage, not just for local banks and startups but for international partners and investors seeking reliable, scalable innovation.

A Digitally Native Financial Infrastructure

Denmark's position in 2026 rests on foundations that were laid more than a decade earlier, when policymakers and financial institutions began to treat digital identity and e-government as core national infrastructure rather than optional conveniences. The nationwide rollout of NemID, and its subsequent evolution into MitID, created a secure, standardized authentication layer that underpins everything from online banking and mortgage applications to tax filing and access to welfare services. This infrastructure has enabled Danish banks and fintech companies to build advanced services on top of a trusted identity backbone, reducing onboarding friction, lowering compliance costs, and sharply limiting fraud. For global observers, this demonstrates how a robust public digital identity, when combined with clear data protection rules inspired by frameworks such as the European Union's General Data Protection Regulation, can accelerate private-sector innovation while maintaining public trust.

Major Nordic institutions such as Danske Bank and Nordea have capitalized on this environment by investing early in mobile-first banking, open APIs, and advanced analytics, effectively turning Denmark into a live testbed for next-generation finance software. Their platforms support everything from instant peer-to-peer payments to integrated wealth management dashboards, and their adoption of open banking principles has allowed smaller fintechs to plug into established infrastructures with relative ease. Readers seeking a broader context on how this compares with developments in other regions can explore global fintech coverage at FinanceTechX Fintech, where Denmark is increasingly referenced alongside larger hubs such as London, New York, and Singapore.

Intelligent, Interconnected Finance Software

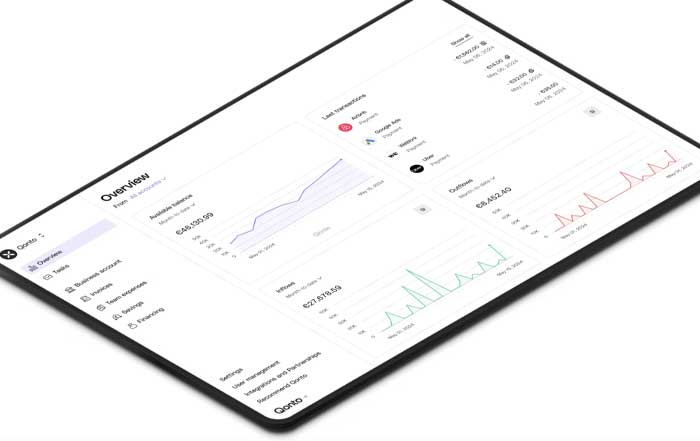

What distinguishes Denmark's fintech landscape in 2026 is not merely the digitization of existing processes but the integration of intelligent, interconnected software that redefines how financial services are designed, delivered, and governed. Danish firms are deploying AI-enhanced platforms that support real-time credit scoring, dynamic pricing, and predictive risk analytics, enabling banks and insurers to act on forward-looking indicators rather than static historical data. These systems draw on a combination of transactional information, macroeconomic signals, and alternative data sources, and they increasingly use explainable AI techniques to satisfy both regulatory requirements and ethical expectations around transparency.

At the same time, blockchain and distributed ledger technologies have moved from experimental pilots to production-grade infrastructure for specific use cases such as cross-border payments, trade finance, and digital asset custody. Danish companies are particularly active in building software that streamlines reconciliation between counterparties, reduces settlement times, and enhances auditability, in line with broader European developments tracked by organizations like the European Banking Authority. For FinanceTechX readers following the convergence of crypto and traditional finance, Denmark's approach underscores how blockchain can be embedded into regulated frameworks rather than existing only in parallel speculative markets, a theme further explored in the platform's dedicated crypto section.

Startup Momentum and the Role of Innovation Hubs

The rise of next-generation finance software in Denmark is inseparable from the dynamism of its startup ecosystem. Companies such as Lunar, which has built a fully digital banking experience targeting both retail and SME segments across the Nordic region, and Pleo, which has redefined expense management and corporate spend control through smart cards and real-time software, illustrate how Danish founders are using cloud-native architectures and user-centric design to solve global problems from a Nordic base. Their growth stories, often backed by international venture capital and strategic partnerships, have validated Denmark as a serious fintech hub rather than a peripheral market.

Central to this momentum is Copenhagen Fintech, which has evolved into a mature innovation cluster connecting entrepreneurs, incumbent banks, regulators, investors, and academic institutions. Its programs and labs support early-stage experimentation and provide a structured pathway from concept to commercialization, while also serving as a platform for international collaboration with ecosystems in the United States, the United Kingdom, Germany, Singapore, and beyond. For readers interested in how founder networks and capital flows shape this environment, FinanceTechX Founders regularly profiles the individuals and teams behind these ventures, highlighting how Danish entrepreneurs combine technical depth with a strong orientation toward responsible innovation.

Regulatory Clarity and Supervisory Innovation

A major pillar of Denmark's success is the regulatory approach taken by the Danish Financial Supervisory Authority, Finanstilsynet, and the broader policy framework shaped in dialogue with the European Commission and other EU bodies. Rather than adopting either a laissez-faire stance or an overly restrictive posture, Danish authorities have pursued a principle-based model that emphasizes proportionality, risk sensitivity, and early engagement with innovators. Regulatory sandboxes and innovation hubs allow fintech firms to test new products under supervised conditions, particularly in areas such as digital lending, robo-advisory, and embedded finance, while still respecting European directives like PSD2 and forthcoming updates on open finance and data sharing.

This balanced approach has made Denmark an attractive jurisdiction for international companies seeking a stable entry point into the European market. It has also encouraged domestic institutions to experiment with technologies such as AI-based credit scoring and digital onboarding within a clearly defined risk and compliance framework, aligned with guidance from organizations such as the Bank for International Settlements. For a broader macroeconomic lens on how such regulatory strategies interact with growth and stability, readers can refer to FinanceTechX Economy, which tracks how digital finance policy is evolving across Europe, North America, and Asia.

Deep Integration With European and Global Markets

Denmark's financial system is fully embedded in European and global networks, and its fintech sector is designed from the outset with cross-border scalability in mind. As part of the European Union's single market and the wider Nordic-Baltic region, Danish companies build software that complies with shared standards on payments, data protection, and capital markets, while also interfacing with global infrastructures such as SWIFT and the initiatives of the European Central Bank. Real-time payment schemes, instant settlement rails, and harmonized regulatory frameworks mean that Danish solutions are often export-ready to markets across the euro area, the United Kingdom, and increasingly Asia-Pacific.

This outward-looking orientation is reinforced by participation in international forums and standard-setting bodies, where Danish regulators and industry leaders contribute to debates on topics like cross-border data flows, digital identity interoperability, and sustainable finance taxonomies. Institutions such as the International Monetary Fund and the World Bank frequently highlight the Nordic model, including Denmark, in analyses of digital public infrastructure and financial inclusion, and this recognition further enhances the credibility of Danish software and services in markets from South Africa and Brazil to Japan and Canada. Readers seeking a wider view of these global dynamics can follow ongoing coverage at FinanceTechX World, where Denmark's role is increasingly framed within a competitive but interconnected global fintech landscape.

Sustainability as a Design Principle, Not a Feature

What sets Denmark apart most visibly by 2026 is the extent to which sustainability is embedded into the design of its financial software and products. National climate commitments, including a legally anchored ambition to reach climate neutrality, have translated into concrete expectations that financial institutions and fintech startups integrate environmental, social, and governance (ESG) criteria into their algorithms, risk models, and customer interfaces. Banks such as Danske Bank and Nykredit now offer investment platforms where ESG scoring, climate scenario analysis, and impact metrics are not optional filters but core components of portfolio construction and reporting.

Danish fintechs are building tools that help asset managers and corporates align with international frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) and the EU's Sustainable Finance Disclosure Regulation, combining granular emissions data with financial performance indicators. These platforms often draw on research from institutions like the OECD and climate data providers to quantify transition and physical risks, enabling investors to understand how portfolios might behave under different climate pathways. For FinanceTechX readers focused on green fintech and sustainable business models, the Danish experience is explored in more depth through the site's environment and green-finance coverage, where Denmark frequently appears as a proving ground for climate-aligned financial technologies.

Artificial Intelligence and Automation at Scale

Artificial intelligence is now deeply woven into Denmark's financial sector, supporting everything from retail customer service to institutional risk management. Banks and fintechs deploy machine learning models for fraud detection, anomaly spotting, and transaction monitoring, reducing false positives while improving the speed and accuracy of responses to suspicious activity. In lending and credit, AI models are used to augment traditional scoring frameworks with alternative data, particularly for SMEs and underbanked segments, while still respecting fairness and non-discrimination principles.

Crucially, Denmark's strong research ecosystem, anchored by institutions such as the Technical University of Denmark (DTU) and Copenhagen Business School, has fostered close collaboration between academia and industry on areas like explainable AI, responsible data use, and algorithmic governance. Joint projects explore how to audit models for bias, document decision logic, and ensure that automated systems remain under meaningful human oversight, aligning with emerging guidance from the European Union's AI Act. For readers tracking how AI is transforming global finance, FinanceTechX AI provides ongoing analysis, with Denmark often cited as an example of how to combine technical sophistication with ethical rigor.

Talent, Education, and the Future Workforce

Denmark's ability to sustain its fintech momentum depends heavily on its talent base, and here it has built a distinctive model that blends strong public education with lifelong learning and international openness. Universities and business schools offer specialized programs in fintech, quantitative finance, and data science, while coding bootcamps and online learning platforms complement formal education with practical skills in cloud computing, cybersecurity, and product design. This ecosystem produces graduates who are comfortable operating at the intersection of finance, technology, and regulation, a combination that is increasingly essential for roles in product management, risk, compliance, and engineering.

The Danish labour market also emphasizes flexibility and social safety nets, which reduces the perceived risk of moving from established institutions into startups, thereby supporting a healthy flow of talent into early-stage ventures. International professionals from Europe, Asia, and North America are drawn by Denmark's quality of life, transparent business culture, and the opportunity to work on globally relevant problems from a Nordic base. For those exploring career paths in this evolving landscape, FinanceTechX Jobs highlights how Denmark and other hubs are competing for fintech talent and how professionals can position themselves for roles that combine AI, cybersecurity, and sustainable finance.

Investment, Capital Flows, and Corporate Venturing

The investment climate for fintech in Denmark has matured significantly, with a blend of local venture funds, international investors, and corporate venture arms backing high-potential companies at various stages of growth. High-profile funding rounds for Pleo, Lunar, and other Danish-founded firms have demonstrated that global investors from the United States, the United Kingdom, Germany, and Asia are willing to deploy substantial capital into Nordic startups that show strong product-market fit and international scalability. This influx of capital has been supported by Denmark's political stability, low levels of corruption, and predictable regulatory environment, which together reduce risk for long-term investors.

Corporate venture arms and innovation units within major Nordic banks and insurers have become particularly active, providing not only funding but also distribution channels, regulatory expertise, and customer access. This has created a hybrid model in which startups can scale more quickly by leveraging incumbent infrastructures, while established institutions gain exposure to disruptive technologies and new revenue streams. For executives and investors wanting to understand how this model compares with other regions, FinanceTechX Business offers comparative insights into corporate-startup collaboration across North America, Europe, and Asia-Pacific, with Denmark consistently highlighted as a case where partnership has delivered measurable results.

Cybersecurity, Digital Trust, and Operational Resilience

As Denmark's financial system becomes more digitized and interconnected, cybersecurity has moved from a specialized technical concern to a board-level priority across banks, payment providers, and fintech platforms. The country's heavy reliance on digital channels means that operational resilience and cyber defense capabilities are now seen as critical components of national economic security. Danish institutions deploy layered security architectures, combining strong authentication, advanced encryption, behavioral analytics, and AI-driven threat detection to protect against increasingly sophisticated attacks.

Regulators and industry associations coordinate closely with European cybersecurity agencies and global organizations such as the ENISA and the Financial Stability Board to share threat intelligence and develop best practices for incident response and recovery. Stress-testing of critical infrastructure, including payment systems and cloud environments, has become routine, and there is growing emphasis on supply-chain security as financial institutions rely more heavily on third-party software and cloud providers. For FinanceTechX readers monitoring developments in digital trust, FinanceTechX Security examines how Denmark and other jurisdictions are adapting governance, technology, and culture to safeguard increasingly software-defined financial systems.

Digital Currencies, Tokenization, and DeFi

In parallel with regulated fintech, Denmark is engaging with the rapidly evolving world of digital currencies, tokenized assets, and decentralized finance. The Danish National Bank has maintained a cautious but active research agenda on central bank digital currencies (CBDCs), collaborating with European partners on potential designs for a digital euro and assessing whether a digital krone would add value in a context where electronic payments are already ubiquitous. While no retail CBDC has yet been launched in Denmark, the policy debate is informed by developments in markets such as China and the euro area, as well as by analysis from institutions like the Bank of England and the Federal Reserve.

On the private side, Danish fintechs and developers are experimenting with tokenization of real-world assets, on-chain collateral management, and DeFi-based liquidity pools, often focusing on institutional-grade applications that can meet regulatory expectations around know-your-customer (KYC), anti-money laundering (AML), and investor protection. These initiatives illustrate how decentralized protocols can be harnessed within a compliant framework, rather than existing entirely outside regulated finance. Readers interested in how these trends intersect with traditional banking and capital markets can follow in-depth coverage at FinanceTechX Crypto, where Denmark's cautious but constructive stance is contrasted with more aggressive or restrictive approaches elsewhere.

Intersections With Emerging Technologies

Denmark's next-generation finance software increasingly intersects with other general-purpose technologies, including 5G connectivity, Internet of Things (IoT) devices, and early-stage quantum computing research. High-speed, low-latency networks enable richer mobile banking experiences, real-time risk monitoring, and new forms of embedded finance integrated into consumer and industrial IoT ecosystems. For example, insurers can use sensor data from connected vehicles or buildings to price risk dynamically, while Danish fintech platforms provide the analytical and transactional layers that convert this data into financial decisions.

On the security side, Danish universities and research centers are exploring quantum-resistant cryptography and the potential implications of quantum computing for financial modeling, portfolio optimization, and derivative pricing, in collaboration with international partners and organizations such as the European Quantum Flagship. These efforts underscore that Denmark is not only adapting to current technologies but also positioning its financial sector for shifts that may redefine the technical foundations of security and computation in the coming decades. For a broader look at how AI and advanced computation are reshaping finance globally, FinanceTechX AI provides ongoing analysis and case studies.

Strategic Lessons for the Global Financial Community

By 2026, Denmark's experience with next-generation finance software offers several strategic lessons for policymakers, financial institutions, and founders around the world. First, it demonstrates that public digital infrastructure-particularly secure digital identity and interoperable payment rails-can dramatically lower the cost and complexity of financial innovation, provided it is designed with privacy and security at its core. Second, it shows that regulatory clarity, combined with mechanisms such as sandboxes and innovation hubs, can foster experimentation without compromising stability or consumer protection, a balance that many jurisdictions in Europe, Asia, Africa, and the Americas are striving to achieve.

Third, Denmark proves that sustainability can be a competitive advantage rather than a regulatory burden when it is embedded directly into software, data models, and product design. Its leadership in green fintech positions it well as global investors, from pension funds in the Netherlands and Canada to sovereign wealth funds in Asia and the Middle East, increasingly demand verifiable climate and ESG performance from their portfolios. For readers seeking to understand how these macro trends play out across different regions, FinanceTechX Economy and FinanceTechX World contextualize Denmark's model within a rapidly evolving global financial architecture.

Denmark and the Future of Software-Defined Finance

As finance becomes ever more software-defined, Denmark's integrated approach-combining digital readiness, regulatory sophistication, entrepreneurial energy, and a deep commitment to sustainability-positions it as a reference model for countries seeking to modernize their financial systems. From New York and London to Singapore, Sydney, and São Paulo, regulators and industry leaders are studying how Danish institutions have aligned incentives, infrastructure, and innovation to create a resilient yet flexible ecosystem. For FinanceTechX, which serves a global readership across banking, fintech, AI, crypto, and green finance, Denmark's story is less a Nordic curiosity and more a strategic case study in how to build financial systems that are efficient, inclusive, secure, and aligned with long-term societal goals.

The coming years will test this model as competition for talent intensifies, cyber threats evolve, and global regulatory frameworks for AI, digital assets, and data sharing become more complex. Yet Denmark's track record of coordinated adaptation suggests that it will continue to refine and export next-generation finance software that shapes practices far beyond its borders. Business leaders, founders, and policymakers who wish to understand and participate in this transformation can follow ongoing developments across fintech, banking, security, and sustainability at FinanceTechX, where Denmark's innovations are tracked not in isolation, but as part of a broader shift toward a more intelligent, transparent, and sustainable global financial system.