Switzerland's Financial Giants in 2026: Tradition, Technology, and the Next Phase of Global Influence

Switzerland's financial sector in 2026 remains one of the most closely watched ecosystems in global finance, not only because of its deep historical roots and reputation for stability, but also because of the way its leading institutions have chosen to respond to an era defined by digital disruption, geopolitical uncertainty, and accelerating sustainability demands. For FinanceTechX, whose audience follows developments across fintech, banking, crypto, artificial intelligence, markets, and the broader global economy, the evolution of Swiss financial giants offers a particularly instructive case study in how a mature, highly regulated market can reinvent itself without losing the core attributes of trust, professionalism, and resilience that made it successful in the first place.

The Swiss model continues to attract capital and talent from every major region, from the United States and the United Kingdom to Germany, Singapore, and the broader Asia-Pacific and African markets, precisely because it combines a conservative risk culture with an unusually high tolerance for technological experimentation. Even after the shock of the 2023 Credit Suisse crisis and its subsequent integration into UBS, Switzerland has reinforced its status as a central node in the global financial system, connecting institutional investors, multinational corporations, family offices, and sovereign wealth funds to a sophisticated mix of traditional banking, asset management, insurance, and cutting-edge fintech. Readers seeking a broader context on how these forces interact across sectors can explore the dedicated coverage on business and financial systems at FinanceTechX.

Historical Resilience and the Foundations of Swiss Financial Power

The enduring strength of Swiss finance in 2026 cannot be understood without reference to its historical evolution. Switzerland's political neutrality, its legal framework protecting property rights and contracts, and its early development of banking secrecy laws in the 1930s created the conditions for a discreet, highly specialized wealth management industry that became synonymous with security and continuity. While traditional banking secrecy has been significantly curtailed over the past decade under pressure from organizations such as the OECD and the Financial Action Task Force (FATF), the underlying culture of client confidentiality, legal rigor, and operational discipline has survived and adapted rather than disappeared. Those seeking context on how these global standards have evolved can review the international guidelines on the OECD's official website.

This long-term orientation proved decisive during multiple crises, from the global financial meltdown of 2008 to the COVID-19 pandemic and the subsequent inflationary and geopolitical shocks that reshaped markets after 2020. Swiss institutions were not immune to losses or reputational challenges, but their diversified business models, high capital buffers, and conservative risk management practices allowed them to remain operational and liquid when many competitors elsewhere were forced into emergency measures. The Swiss National Bank (SNB), working alongside the Swiss Financial Market Supervisory Authority (FINMA) and the federal government, has consistently prioritized systemic stability, a stance that was particularly visible in the emergency backstop for Credit Suisse in 2023. For readers interested in macroeconomic dynamics surrounding these decisions, FinanceTechX provides additional analysis in its economy and markets section.

UBS After Credit Suisse: A New Global Superbank

By 2026, UBS stands as one of the most consequential financial institutions in the world, having absorbed the core operations of Credit Suisse and integrated them into a single, enlarged platform in wealth management, investment banking, and asset management. The combined entity now oversees trillions of dollars in assets under management and exerts considerable influence over cross-border capital flows between Europe, North America, Asia, and the Middle East. This concentration has amplified both the opportunities and the responsibilities facing Swiss regulators and policymakers, who must balance the benefits of scale with the risks inherent in a "too big to fail" institution.

The post-merger strategy of UBS has revolved around three pillars: digital transformation, sustainable finance, and global client coverage. On the digital side, the bank has invested heavily in cloud-native platforms, AI-driven advisory tools, and integrated digital channels that serve private clients, institutional investors, and corporate treasurers in a unified architecture. This transformation reflects a broader global trend, as documented in industry analyses by organizations such as McKinsey & Company, which has examined how large banks are restructuring their technology stacks to compete with fintechs and big tech platforms; interested readers can review these perspectives on McKinsey's banking insights.

Simultaneously, UBS has positioned itself as a leading advocate of sustainable finance, embedding environmental, social, and governance (ESG) criteria into its advisory processes and product design. The bank's global reach allows it to connect European and North American institutional capital with green infrastructure projects in Asia, Latin America, and Africa, aligning with frameworks promoted by bodies such as the United Nations Principles for Responsible Investment (UN PRI). For professionals tracking how such strategies translate into practical tools and digital products, FinanceTechX offers complementary coverage in its banking innovation hub.

Private Wealth Management and the Next Generation of Global Clients

Beyond UBS, Switzerland's reputation as a premier center for private wealth management remains anchored in firms such as Julius Baer, Pictet Group, and Lombard Odier, which have cultivated multi-generational relationships with high-net-worth and ultra-high-net-worth families from Europe, the United States, the Middle East, Asia, and increasingly Africa and Latin America. These institutions have historically differentiated themselves through bespoke advisory services, deep expertise in complex cross-border tax and legal structures, and a holistic approach to family governance, philanthropy, and succession planning.

The demographic and cultural profile of wealth, however, is changing rapidly. Younger beneficiaries in the United States, Germany, the United Kingdom, Singapore, and beyond are more digitally native, more vocal about values such as sustainability and social impact, and more open to alternative assets including private equity, venture capital, and digital assets. Swiss private banks have responded by expanding their digital interfaces, integrating advanced data analytics into portfolio construction, and offering impact-focused strategies that go beyond traditional ESG screening. Detailed principles for such investing can be explored through resources like the UN PRI's sustainable investment guidance, which many Swiss managers reference when designing their frameworks.

In parallel, these institutions have moved closer to the startup and innovation ecosystems, co-investing with venture funds, supporting family offices in direct deals, and building dedicated teams focused on technology, healthcare, and climate-related opportunities. For readers interested in how founders and investors intersect in this new landscape, FinanceTechX provides ongoing insights in its coverage of founders and entrepreneurial finance.

Insurance, Reinsurance, and the Architecture of Global Risk

Switzerland's financial influence extends well beyond banking and wealth management through its globally significant insurance and reinsurance sector, led by firms such as Swiss Re and Zurich Insurance Group. These organizations provide the risk-transfer mechanisms that underpin infrastructure projects, corporate balance sheets, and national disaster recovery frameworks around the world. In an era of intensifying climate risk, cyber threats, and geopolitical volatility, their role has become even more strategic.

Swiss Re has been at the forefront of developing sophisticated catastrophe models and climate-risk analytics, incorporating scientific research from institutions like the Intergovernmental Panel on Climate Change (IPCC) into its underwriting and advisory processes. Professionals interested in the scientific basis for these models can consult the IPCC's official assessments, which inform many of the risk scenarios used across the industry. Zurich Insurance Group, meanwhile, has expanded its digital capabilities, offering more personalized, data-driven products to corporate and retail clients, while aligning its investment portfolio with net-zero targets and the Paris Agreement.

The interdependence between these insurers and the broader financial system is increasingly recognized by regulators and central banks worldwide, including the European Central Bank and the Bank of England, which have integrated climate and insurance-related risks into their financial stability assessments. For readers following these systemic linkages, FinanceTechX offers additional context in its coverage of global financial developments.

Switzerland as a Fintech and Digital Finance Laboratory

While Switzerland has long been associated with conservatism in finance, the past decade has seen it emerge as one of the most dynamic fintech hubs in Europe, particularly in the fields of wealthtech, regtech, and blockchain-based financial services. Cities such as Zurich, Geneva, and Zug host a dense concentration of startups, accelerators, and innovation labs, many of which collaborate directly with incumbent banks and insurers rather than seeking to displace them.

The regulatory posture of FINMA has been critical in this evolution. By providing clear licensing regimes for fintech banks, sandbox environments for experimentation, and detailed guidance on digital assets, the authority has given entrepreneurs and established players the regulatory certainty they need to invest in long-term innovation. Comparative assessments by organizations such as the World Bank and the International Monetary Fund (IMF) have highlighted Switzerland's approach as an example of how to balance innovation with consumer protection; additional context can be found in the IMF's financial sector assessments.

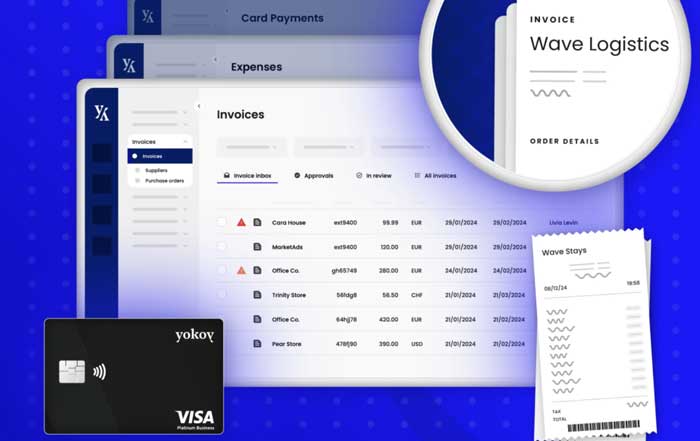

Within this environment, Swiss institutions have embraced open banking, API-based integration, and cloud-native architectures. Collaboration between incumbents and startups has accelerated the development of digital onboarding, algorithmic portfolio management, and automated compliance tools. For a closer look at how these trends intersect with global fintech developments, readers can explore the fintech insights and case studies curated by FinanceTechX in its fintech section.

Artificial Intelligence as a Strategic Differentiator

In 2026, artificial intelligence has moved from being a promising add-on to a core strategic capability for Swiss financial institutions. Banks, insurers, and asset managers deploy AI across the value chain, from front-office client interaction to middle-office risk analytics and back-office operations. Natural language processing and generative AI tools are used to summarize complex research, personalize communication with clients, and assist relationship managers in preparing proposals tailored to the specific circumstances of families or institutions in markets as diverse as Canada, Australia, Japan, and South Africa.

In risk management and compliance, machine learning models monitor transactions for anomalies, support anti-money-laundering (AML) efforts, and anticipate credit and market risk under different macroeconomic scenarios. These capabilities are especially important as regulatory expectations around real-time monitoring and stress testing increase, influenced by guidance from bodies such as the Bank for International Settlements (BIS), headquartered in Basel. The BIS has published extensive research on AI in finance and the implications for central banking and regulation, which can be explored on its official website.

Swiss institutions are also conscious of the ethical and governance challenges associated with AI, including data privacy, algorithmic bias, and model transparency. Many have adopted internal frameworks aligned with emerging international standards, while engaging with academic research centers and technology providers to ensure that AI augments, rather than replaces, human judgment in critical decisions. Readers following the intersection of AI, finance, and regulation can find complementary reporting and analysis on FinanceTechX in its dedicated AI and financial innovation hub.

Crypto, Distributed Ledger Technology, and the Evolution of Digital Assets

Switzerland's role in the global digital asset ecosystem remains disproportionately large relative to its size. The region around Zug, often referred to as Crypto Valley, has attracted blockchain foundations, protocol developers, and regulated financial intermediaries from across Europe, North America, and Asia. Early decisions to clarify the legal status of tokens, create a licensing regime for crypto banks, and adopt the Swiss Distributed Ledger Technology (DLT) Law have given entrepreneurs a predictable environment in which to build.

Licensed institutions such as SEBA Bank and Sygnum Bank have demonstrated that it is possible to combine traditional banking rigor with crypto-native services, offering custody, trading, staking, and tokenization within a regulated framework. Their success has encouraged established banks and wealth managers to incorporate digital assets into their offerings, not as speculative side products but as part of a broader strategy around tokenized securities, real-world asset tokenization, and programmable finance. Global best practices and regulatory discussions on these topics can be followed through resources such as the Financial Stability Board (FSB), which provides analysis on crypto-asset markets and regulation.

At the same time, Swiss authorities have maintained strict standards on AML, know-your-customer (KYC) procedures, and operational resilience for crypto service providers, reinforcing the country's reputation as a trustworthy jurisdiction for institutional participation in digital assets. For readers examining how crypto, DeFi, and traditional finance converge, FinanceTechX continues to track these developments in its crypto and digital assets coverage.

Sustainable and Green Finance as a Core Strategic Theme

One of the most striking shifts in Swiss finance over the past decade has been the mainstreaming of sustainable and green finance. What began as a niche offering has become a central pillar of strategy for banks, asset managers, and insurers, driven by regulatory expectations, client demand, and a growing recognition of the financial materiality of climate and biodiversity risks. Swiss institutions are deeply involved in international initiatives such as the Glasgow Financial Alliance for Net Zero (GFANZ), the Net-Zero Asset Owner Alliance, and the Task Force on Climate-related Financial Disclosures (TCFD), which have set standards for transition plans, portfolio alignment, and climate-risk reporting. Detailed frameworks for climate disclosure are available through the TCFD's official resources.

In practice, this has translated into large-scale reallocation of capital toward renewable energy, energy efficiency, sustainable infrastructure, and nature-based solutions, as well as the development of sophisticated impact measurement tools. Private banks and institutional managers headquartered in Geneva and Zurich are increasingly asked by clients in the United States, Europe, and Asia to demonstrate how their investments contribute to measurable environmental and social outcomes, rather than simply excluding certain sectors. For professionals exploring how green finance intersects with digital innovation, FinanceTechX provides focused reporting in its green fintech and sustainability section, as well as related insights in its environment and climate finance coverage.

Swiss re/insurers also play a pivotal role in supporting the global green transition, both through underwriting renewable projects and by developing products that help corporates and governments manage transition and physical risks. Their collaboration with development banks, NGOs, and multilateral organizations is reshaping how risk-sharing mechanisms support climate adaptation in emerging markets across Africa, Asia, and South America.

International Financial Diplomacy and the Role of Switzerland in Global Standards

Switzerland's influence in global finance is amplified by its role as a neutral convening hub and the host of key international institutions. The Bank for International Settlements in Basel serves as the "central bank for central banks," providing a platform for coordination on monetary policy, macroprudential regulation, and emerging topics such as central bank digital currencies (CBDCs). The Swiss National Bank has been actively engaged in cross-border CBDC experiments, including Project Helvetia and collaborations with the European Central Bank and other central banks, exploring how distributed ledger technology can improve wholesale payments and securities settlement. Those interested in the policy and technical aspects of these initiatives can consult the ECB's digital euro and CBDC research.

Beyond central banking, Switzerland participates in standard-setting bodies and working groups focused on issues ranging from anti-money-laundering and tax transparency to cyber resilience and operational risk, often acting as a bridge between the regulatory philosophies of Europe, North America, and Asia. This diplomatic function is particularly important as financial markets become more fragmented by geopolitical tensions, sanctions regimes, and diverging data governance rules. For readers tracking how these global forces shape business and investment strategies, FinanceTechX offers ongoing analysis in its world and geopolitics in finance section.

Strategic Challenges and Opportunities for the Next Decade

Despite its strengths, the Swiss financial sector faces a complex set of challenges as it looks beyond 2026. The consolidation of Credit Suisse into UBS has raised questions about concentration risk and competition, prompting regulators and policymakers to reassess resolution frameworks, capital requirements, and governance standards for systemically important institutions. Cybersecurity remains a persistent concern, as increasingly digital business models expand the attack surface for sophisticated threat actors; global standards and best practices in this area are frequently discussed by organizations such as the World Economic Forum, which publishes insights on cyber resilience in financial services.

In parallel, Switzerland must navigate intensifying competition from financial centers in the United States, the United Kingdom, the European Union, and Asia, particularly Singapore and Hong Kong, which are vying for leadership in wealth management, fintech, and digital assets. Talent acquisition and retention, regulatory agility, and the ability to scale innovation across global networks will determine whether Swiss institutions can maintain their premium positioning.

Yet the opportunity set is equally significant. Switzerland is uniquely placed to lead the convergence of traditional finance with AI, blockchain, and sustainability, leveraging its reputation for trust and expertise to attract institutional investors, founders, and policy innovators from every major region. The country's ecosystem of banks, asset managers, insurers, fintechs, and academic institutions is already experimenting with tokenized real-world assets, AI-enhanced risk models, and integrated ESG analytics that could become templates for global adoption. For professionals exploring how these threads come together across jobs, skills, and new business models, FinanceTechX provides additional perspectives in its jobs and future-of-work coverage and its broader news and analysis hub.

As the financial landscape continues to evolve, the Swiss experience demonstrates that enduring competitive advantage in finance is no longer built solely on secrecy or tax arbitrage, but on the ability to combine long-term institutional memory with relentless innovation, robust regulation, and a credible commitment to global public goods such as financial stability and climate resilience. For the global audience of FinanceTechX, watching how Switzerland's financial giants navigate this next chapter offers a powerful lens on the future of finance itself.